Around the world, digital infrastructure has leapt forward at a pace few expected just a few years ago. Behind every AI prompt, search, or cloud transaction sits an immense physical operation: the data center. As we move into 2026, both the volume and complexity of data center development have grown rapidly, fed by the AI revolution and the mounting need for constant, available computing. This guide unpacks where the world’s data center industry is now, what has driven this rapid expansion, and what 2026 is forecast to look like across each region.

Global Data Center Trends 2026

Not long ago, data centers were mostly built to handle storage, web hosting, and business processes. Today, AI — with its insatiable appetite for GPUs, high-speed networking, and power — has flipped all assumptions on their heads. Take OpenAI, Oracle, and SoftBank: through their Stargate project, they’re putting trillions of dollars into the United States’ AI infrastructure. Nvidia has pledged hundreds of billions towards these same goals.

Across continents, these sprawling facilities are now engrossed in a computational arms race. In 2023 alone, data centers consumed 4.4% of all electricity used in the United States, and some projections suggest this could reach 7 to 12% by 2028. It’s become clear: the infrastructure driving the AI revolution can no longer be an afterthought. Below, we shed light on the most defining trends shaping 2026 for data centers in North America, Europe, the Middle East and Africa, Asia-Pacific, and Latin America.

North America: Demand Shifts to New Regions

Surpassing Old Benchmarks

This past year, North America experienced historic absorption figures unlike any previous period. Much of the demand surge comes directly from AI expansion. In some quarters, growth outpaced entire previous years, thanks to the rapid entrance of so-called “neo clouds” and hyperscale providers.

Rather than sticking to major metropolitan markets, providers are targeting midwestern locations such as North Dakota, Wyoming, and Missouri — areas not traditionally seen as digital infrastructure hubs. This change is fueled by the search for abundant, affordable power and available land, as many of the usual urban sites have hit resource limits.

Return of the Enterprise

While hyperscalers still dominate headlines, there’s a fresh appetite from smaller enterprises. Instead of building gigawatt campuses, this group is asking for more modest deployments (20-50 megawatts) and finding new opportunities as larger tenants migrate to different markets. The regional focus has broadened: projects as large as 11 gigawatts are being planned for West Texas, with further interest growing in Louisiana, Mississippi, and the Midwest.

Canada’s New Momentum

Canada is seeing renewed traction, especially in Calgary and surrounding areas, driven by government policies encouraging data residency and local sovereignty. Power availability and partnerships with globally recognized cloud platforms position Calgary and traditional markets such as Toronto and Montreal for continued growth.

Europe and the Middle East: Diversification and New Hotspots

Broad Market Engagement

Activity across Europe has been widespread. In the Nordics, cheaper energy and lower capacity costs have attracted new entrants eager to establish facilities. Southern European hubs like Lisbon have experienced rapid scaling, growing by 90% in a single year from a modest foundation.

Traditional markets — Frankfurt, Amsterdam, Paris, and London — remain active, though some, like Dublin, face development moratoriums that temporarily pause growth.

Capacity Waiting List and Delayed Availability

Unlike Asia-Pacific, where customers seek quick access to large deployments, much of Europe faces delayed capacity. Deals finalizing in late 2025 are only expected to be ready by the end of 2026 or even later, as speculative builds become less common. This has led to intensified focus on energy alternatives and efficiency.

Middle Eastern Accelerators

The Middle East is emerging with ambitious announcements: some locations are preparing five-gigawatt campuses to draw in the global AI sector. Their geographic proximity to Europe and Asia, coupled with strategic investments from countries like South Korea, signal the region’s intent to become a major non-North American hub for AI-centric data centers.

Asia-Pacific: Explosive Growth, Fast Fulfillment

Massive Doubling in Capacity

Since 2023, overall data center capacity in Asia-Pacific has essentially doubled. Regional totals jumped from 5 gigawatts in 2023 to nearly 10 gigawatts now — a scale that just a few years ago would have seemed unthinkable. Countries like Japan and markets across Southeast Asia are being driven both by domestic and international hyperscaler demand, particularly from Chinese cloud providers. U.S. hyperscalers are shifting towards self-built facilities or build-to-suit agreements.

Australia exemplifies a new focus on national AI sovereignty, seeking to keep cloud data inside national borders. Meanwhile, India has transformed from an emerging prospect to one of Asia’s largest markets. Its rapid acceleration means it could soon surpass Tokyo in terms of total capacity.

Shifting to Secondary and Tertiary Markets

Power constraints in traditional Tier 1 locations have led both AI and cloud providers to secondary cities. These emerging hotspots, including Johor in Malaysia, Chennai in India, Melbourne in Australia, Bangkok, and Vietnam, are seeing huge deployments — sometimes in 100-megawatt increments, a scale previously unseen.

Fast-Tracked Fulfillment

In contrast to the slower, delayed project timelines in Europe, Asia-Pacific customers are demanding and receiving gigawatt-scale capacities in just a few months. Contracts for 100+ megawatts with six-month delivery schedules in Australia’s Perth, Melbourne, and Western Sydney paint a picture of an industry now engineered for speed.

Latin America: The Rise of New Leaders

Chinese Clouds Move In

Latin America’s story in 2025 saw Chinese cloud companies expand aggressively throughout Mexico, Brazil, Chile, and Peru. While North American hyperscalers have temporarily refocused on their home markets, this has allowed new players to claim sizable market share.

Brazil’s Continuing Dominance

Brazil remains the central force, thanks to its mature digital infrastructure, vast economic size, and forward-thinking policy changes. Recent moves to slash import taxes on GPU chips (from 55% down to 2%) remove the final barriers for major AI infrastructure investment. São Paulo alone generates about 40% of Latin America’s economic base, placing it at the core of all regional expansion.

Argentina and Emergent Opportunity

Argentina is quietly becoming a focal point, largely due to natural gas discoveries enabling low-cost power generation. This could, with the right infrastructure, lure major AI data centers looking for affordable electricity, coupled with favorable government incentives.

Political, Regulatory, and Resource Themes

Across Latin America, each country is working to position itself as the destination for U.S. and global cloud investments — boasting high renewable energy penetration (often above 70%), low land costs, and efforts to address past tax and regulatory barriers. Yet, resource availability, especially water and reliable grid power, along with political stability, will shape which countries claim the next wave of projects.

Industry-Wide Shifts: Data Center Power, Cooling, and Design

Unprecedented Power and Density

AI training and inference workloads have driven facilities toward entirely new operating realities. Racks now commonly consume 80 to 120 kilowatts, with projections nearing 600 kilowatts per rack later in the decade. This increased load demands advanced cooling methods: liquid cooling is now more prevalent, and water use effectiveness is tightly managed. Designs often aim for fully closed loop systems with near-zero water loss.

New Models for Construction and Operations

What once took two years to build can now, through innovative design and streamlined permitting, come online in a matter of months, especially when backed by urgent AI demand. The maturation of modular, scalable designs enables faster expansions and easier adaptation to changing tenant requirements.

Advanced Security and Sovereignty

Facilities continue to operate at the highest security standards, both physically and digitally, with extensive biometrics, surveillance, and access restrictions. Increasingly, government directives on data residency and digital sovereignty are shaping where facilities are located and how they are operated, as seen in Canada and Australia.

The Outlook of Data Centers for 2026 and Beyond

What we see globally is an industry defined by agility and adaptation. As demand for massive AI workloads persists, providers and hyperscalers are pushing into new geographic territory, reshaping the map of where digital infrastructure is anchored. Every major data center market is now tuned to considerations like power availability, government cooperation, and the need for both rapid scale and responsible resource management.

The years ahead will bring even larger deployments, new technological challenges, and a continued race to balance computing needs with local community and environmental requirements. For anyone invested in digital infrastructure, 2026 is set to mark another milestone in this ongoing transformation of the data center world.

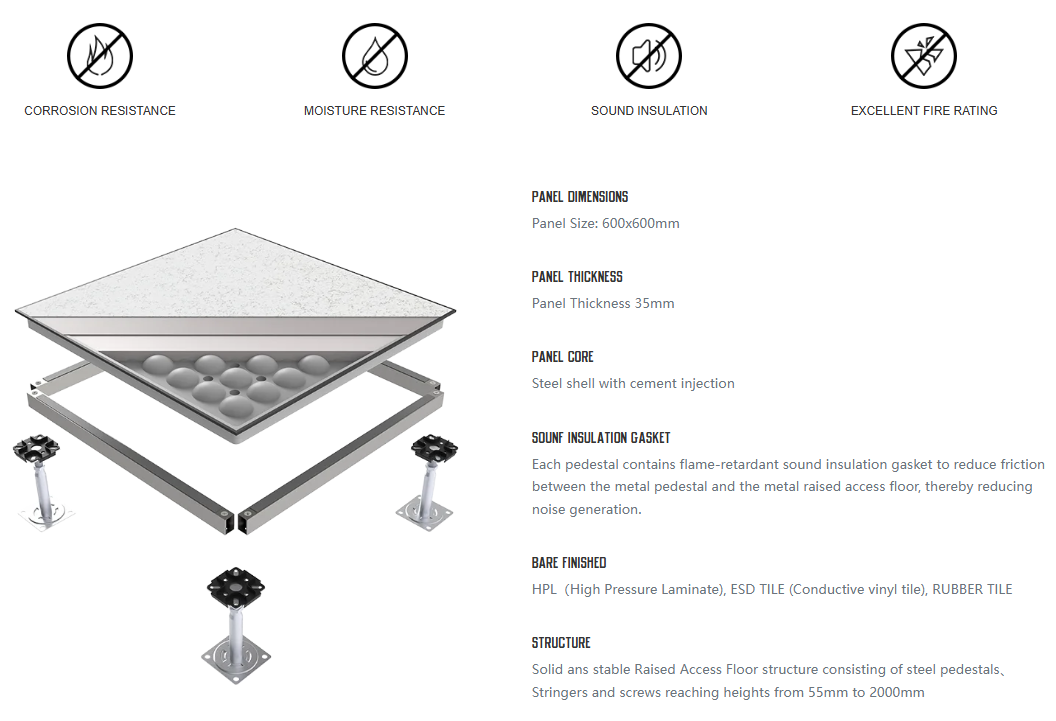

Raised Access Floors for Data Centers by HUIYA

HUIYA GROUP specializes in advanced raised access floor systems that are ideally suited for the demanding environments of modern data centers. Their product range includes steel cementitious laminate, high-density calcium sulfate, particle board, and perforated panels—each rigorously engineered to meet the robust load-bearing, anti-static, and cooling needs unique to data centers. HUIYA’s access floors are manufactured in strict accordance with global standards such as CISCA (American), EN 12825 (European), KS F 4760 (Korean), and JIS A 1450:2005 (Japanese), ensuring compatibility and reliability for international projects. The innovative panel designs, including the HUIYA-SCL, HUIYA-CSL, and HUIYA-SP45 series, provide flexible and modular solutions that support efficient cable management and optimized airflow, crucial for maintaining optimal operating temperatures of sensitive IT equipment. With EPD-certified environmentally friendly materials and a commitment to sustainable production, HUIYA’s access floors deliver both performance and environmental responsibility in mission-critical data center applications.

Huiya Real-Time News

Huiya Real-Time News is dedicated to providing you with the latest and most authoritative information on the raised flooring industry.

We provide 24/7 updates on industry policy interpretations, market trend analysis, company news.

Global Data Center Trends 2026

匯亜、新たに塩霧試験装置を導入 OAフロアの品質防線を強化

회아, 새 염무시험장비 도입해 이중바닥재 품질 방호선 단단히 만듦

MORE DOWNLOADS

GENERAL CATALOGUE

HUIYA INTRODUCTION

HUIYA GREEN LABEL

CAD/BIM FULL STEEL

APPLICATION SCENARIOS